If you’ve got an excitable homeowner on your Christmas list this year, might I suggest a book of matches for his or her stocking. That way they’ll able to light their hair on fire upon receiving their property assessment notice in early January.

The Town of Okotoks has given homeowners a heads-up that those upcoming assessment notices will include, on average, a 20 per cent increase in values. This should be looked upon as good news because it means that homeowners have built a considerable amount of equity in a short period of time, but in many households, the notice will be met with trepidation, even outrage.

That’s because I’ve found assessments are just about the most misunderstood aspect of local government, often getting taxpayers riled up for absolutely no reason. I suspect that will be the case again early next month.

Although it’s true that assessments are used to determine how much property tax a homeowner will pay, the line between the two isn’t as direct as some people assume. Just because your assessment went up 20 per cent, that doesn’t mean your taxes will follow suit.

When it comes to assessments, I like to say it's all about averages. When a town announces a tax hike, it will often say the average home will pay ‘X’ amount more the following year. It doesn’t matter what the average home is valued at, all that matters is that it’s average.

The average home in Okotoks has increased in value by about a hundred grand over the past year, but it’s still an average home, which means its property tax bill will rise by 4.6 per cent next year, the amount set by Okotoks council when it approved the 2024 municipal budget last month.

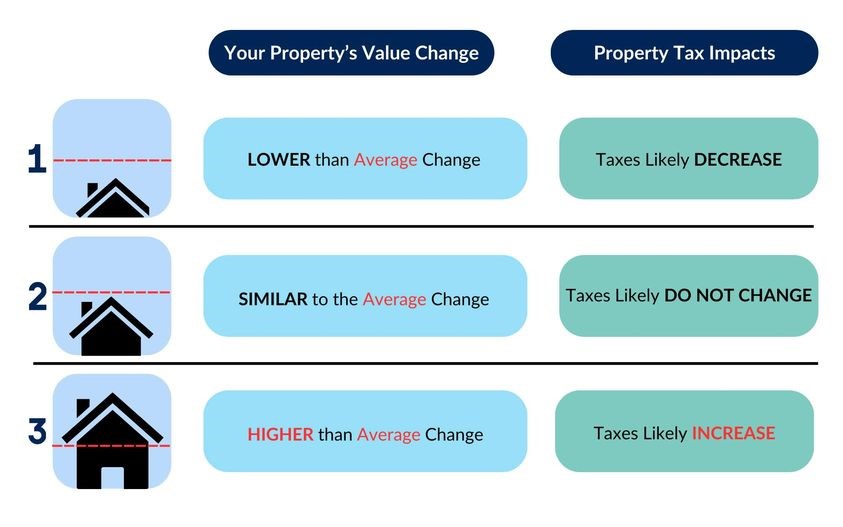

The only time a homeowner sees tax implications, both good and bad, as a direct result of assessment notices is when they deviate from the average to a significant extent. If the average home has increased by 20 per cent, but your home is up 30 per cent, it has effectively jumped into a slightly higher tax bracket, so you’re going to pay more. The opposite holds true if your home hasn’t increased as much as the average.

For homes that were within a percentage point or two of the average, which is most of them, their tax bill will have far more to do with the rate set by council.

Local governments don’t financially benefit from rising real estate prices because the mill rate (the amount of tax charged for every dollar of assessed value) is reduced to offset those increased values. If the rate wasn’t scaled back, then property taxes would rise in step with house prices and homeowner outrage would be warranted, but that simply doesn’t happen.

The Town doesn’t need 20 per cent more revenue to run its operations next year, so it won’t be collecting 20 per cent more in property taxes. Unfortunately, that reality won’t stop a certain number of homeowners from reaching for that book of matches immediately upon opening their assessment notices next month.